Predict Which Insurance Products to Offer

Overview

Business Problem

Insurance companies have limited opportunities to interact with customers, so they need to make the most out of each interaction by only recommending relevant offers. Even with this focus, the conversion rates insurers capture are often suboptimal and maximizing their limited customer interactions remains a challenge. In addition, because insurers have hundreds of agents with whom to coordinate offers, managing conversion rates across these large sales organizations brings more complexities.

Intelligent Solution

AI helps insurers and their agents maximize their conversion rates by offering customers and prospects the products they are most likely to accept. This allows them to increase the Annual Premium Equivalent (APE) of sales made by agents since they are able to optimize the few interactions they have with customers.

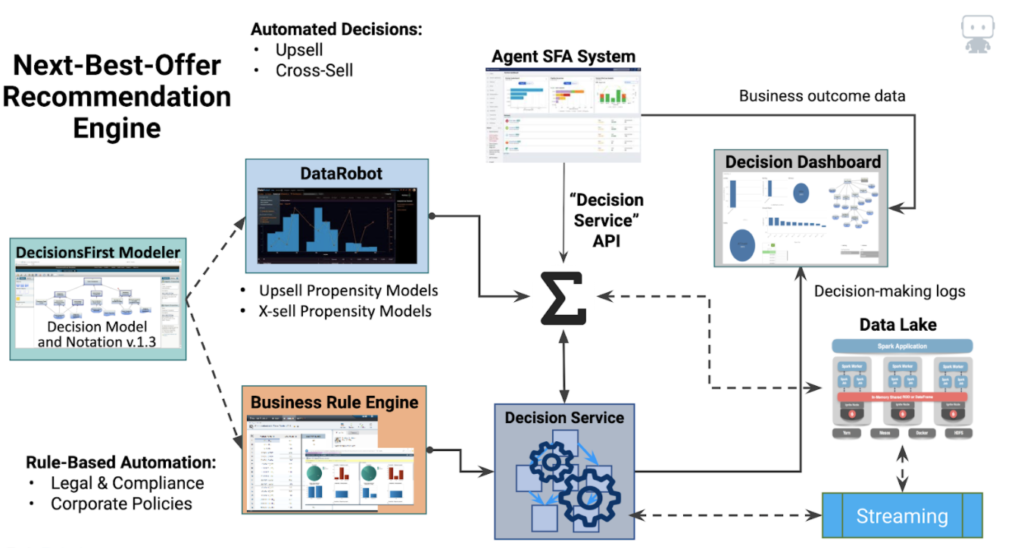

Since the insurance space requires that customers are offered products they are eligible to accept, AI models are used in tandem with Business Rules Management Systems (BRMS) which implement hard-coded rules identifying a customer’s eligibility for products. A rules engine is better suited for this purpose since it does not require probabilistic interpretation. Once the rules engine filters the products which the customer is eligible for, the AI model would rank the remaining products in the order of having the highest likelihood of acceptance.

Value Estimation

How would I measure ROI for my use case?

You can measure ROI by conducting an A/B test. Randomly assign sales agents into one of two groups: treatment group and control group. Sales agents in the treatment group use the results of DataRobot machine learning to recommend offers during their sales conversation. In contrast, sales agents in the control group use the existing method to recommend offers during sales conversations. Then you measure the difference in sales performance between the two groups. Since we expect lower sales for the agents in the control group, you may need to adjust their KPIs to reflect these changes. Insurers implementing next best offer use cases have generated an uplift in revenue of $5,000,000 to $15,000,000 in the first year, through about a 10% to 20% increase in cross-sell revenue from previous approaches.

Another possibility is to measure the difference in sales performances of the same sales agent both before and after using DataRobot machine learning, taking into consideration trends and seasonality. The sum differences for all sales agents becomes the total ROI.

Technical Implementation

About the Data

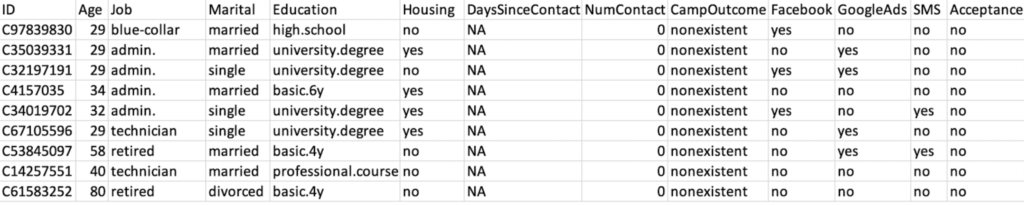

For illustrative purposes, we have developed a synthetic dataset which resembles the data required to build a cross-sell propensity model. We are trying to see which auto policy holders will be interested in also purchasing a health policy. The simulated dataset consists of 10,000 rows and 13 columns.

While this example focuses on one health insurance product, for your purposes you will want to create cross-sell propensity models for all of your available products. The scores from these models will feed the business rules engine, which determines the best cross-sell offer for each individual customer.

This also applies to other financial products such as variable annuities, term life insurance, and more.

Problem Framing

The target variable for this use case is whether or not an auto policy customer will accept a health policy offer recommended by the sales agent. In this dataset, 1,053 of 10,000 offers are accepted.

There are 12 input features consisting of customer demographics data, marketing data, and policy data. These features help DataRobot extract relevant patterns to identify the next best offer.

Beyond these features, we suggest incorporating any additional data your organization may collect that could be relevant to identify the next best offer. For example, if you have made offers in the past across various economic situations, it might help to use public data on macroeconomics, including unemployment rate, consumer confidence, government bonds, and so on. You can also add claims data or data for products that customers purchased in the past. DataRobot will automatically differentiate between important and unimportant features.

Sample Feature List

| Feature Name | Data Type | Description | Data Source | Example |

|---|---|---|---|---|

| ID | Numeric | Customer ID | Customer | C97839830 |

| Age | Numeric | Age of the customer at the time of campaign | Customer | 29 |

| Job | Categorical | Customer’s job category | Customer | blue-collar |

| Marital | Categorical | Customer’s marital status | Customer | married |

| Education | Categorical | Customer’s highest achieved education level | Customer | high.school |

| Housing | Categorical | Whether the customer owns their home | Customer | no |

| DaySinceContact | Numeric | Number of days since the previous marketing contact with the customer | Marketing | 3 |

| NumContact | Numeric | Number of times the company was in contact with the customer during the previous campaign | Marketing | 0 |

| CampOutcome | Categorical | Whether the customer purchased during the previous campaign | Policy | failure |

| Categorical | Whether Facebook advertising was active during the period of this campaign | Marketing | yes | |

| GoogleAds | Categorical | Whether Google advertising was active during the period of this campaign | Marketing | no |

| SMS | Categorical | Whether the campaign message was sent via SMS to this customer | Marketing | no |

| Acceptance | Categorical | Whether the customer accepted the offer during the campaign period | Policy | no |

Data Preparation

Each record is a customer. To prepare the data, first identify which customers have auto insurance policies. Then, you merge customer demographics and policy data using the customer ID identified above. Finally, you identify records related to the given health product campaign, which is available in your marketing data, and merge this with the customer and policy data you created previously. To avoid target leakage in your model, make sure to use only data known before or at the time of offer acceptance.

Model Training

DataRobot Automated Machine Learning automates many parts of the modeling pipeline. Instead of hand-coding and manually testing dozens of models to find the one that best fits your needs, DataRobot automatically runs dozens of models and finds the most accurate one for you, all in a matter of minutes. In addition to training the models, DataRobot automates other steps in the modeling process such as processing and partitioning the dataset.

We will jump straight to interpreting the model results. Take a look here to see how to use DataRobot from start to finish and how to understand the data science methodologies embedded in its automation.

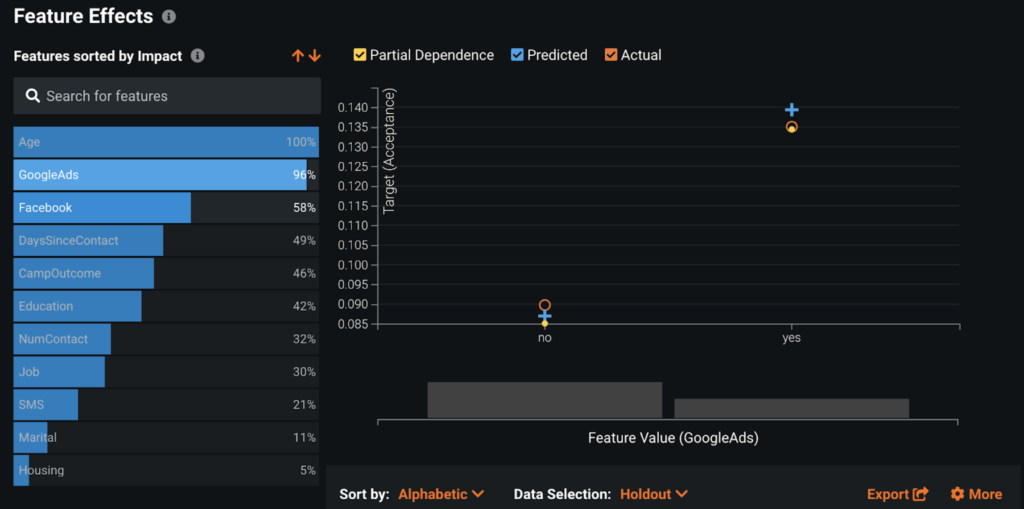

Interpret Results

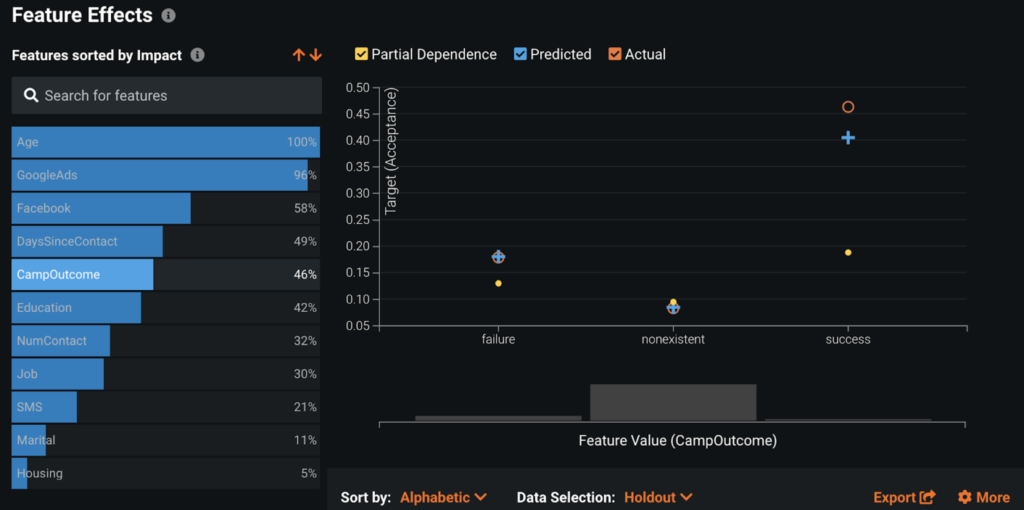

By taking a look at the Feature Impact chart, we discover that Age and GoogleAds are among the strongest features in identifying which customers are likely to accept the offer. The Feature Effects plot here on GoogleAds shows that running GoogleAds results in about a 5% increase in acceptance rate.

As expected, whether or not the customer purchased during the previous campaign is another strong feature influencing the prediction. Customers who accepted the offer in the past campaign are about 5% more likely to accept the offer this time.

Prediction Explanations provides up to 10 reasons for each prediction score. This allows sales agents to understand the reasons behind why each person is likely to accept or reject an offer. For example, DataRobot not only predicts that the customer 1102 has a 74.1% chance of accepting the offer but also explains that the score is high because the customer was contacted recently, possibly saw the Facebook ads, and made a purchase in the previous campaign.

Evaluate Accuracy

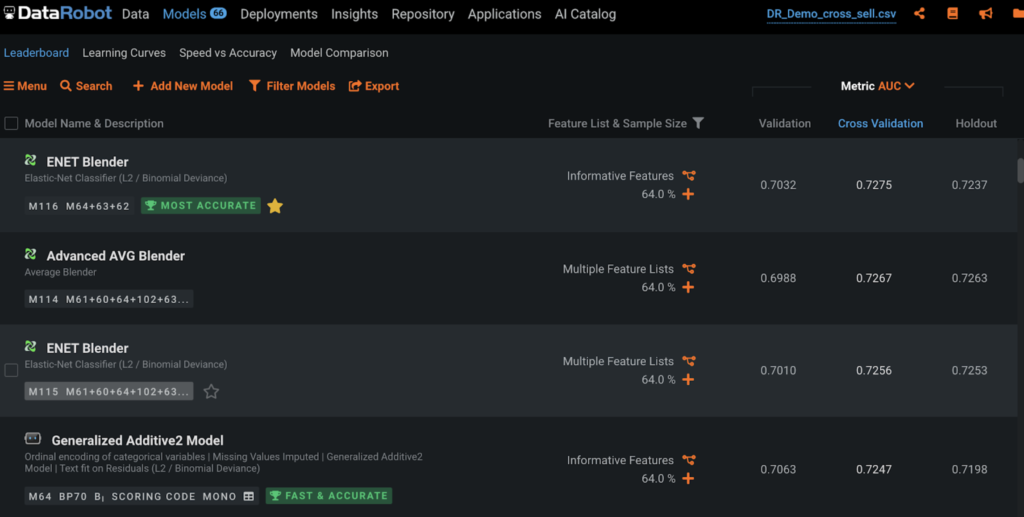

With the synthetic data we created, DataRobot shows that ENET Blender, an ensemble of three single models, is the most accurate model with 0.73 AUC on cross validation. The high accuracy indicates that the model has done the best job of learning signals in the data to distinguish those who accept the offer from those who reject. That said, if predictions need to be made in real-time and are required to have low latency, it would be better to have a faster but less accurate single model, such as Generalized Additive2 Model.

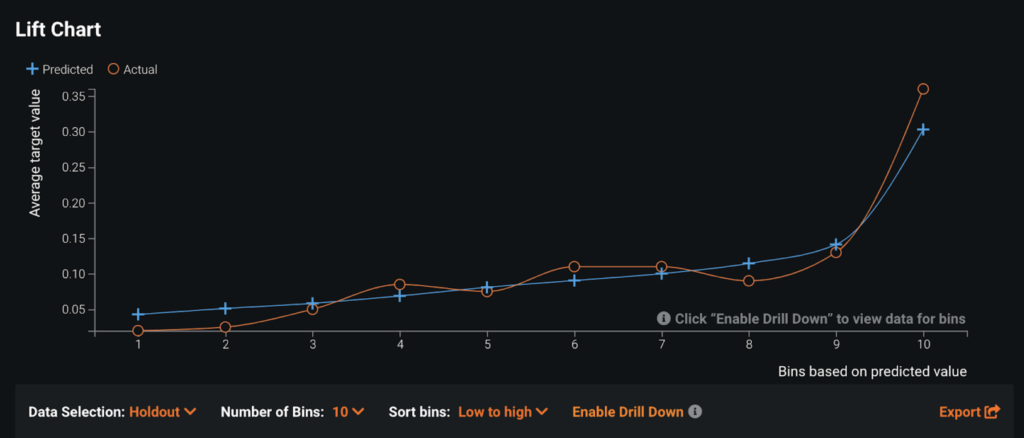

The steep increase in the average target value in the right side of the Lift Chart reveals that when the model predicts that the customer has a high probability of accepting the offer (blue line), the customer tends to indeed accept the offer (orange line, actuals).

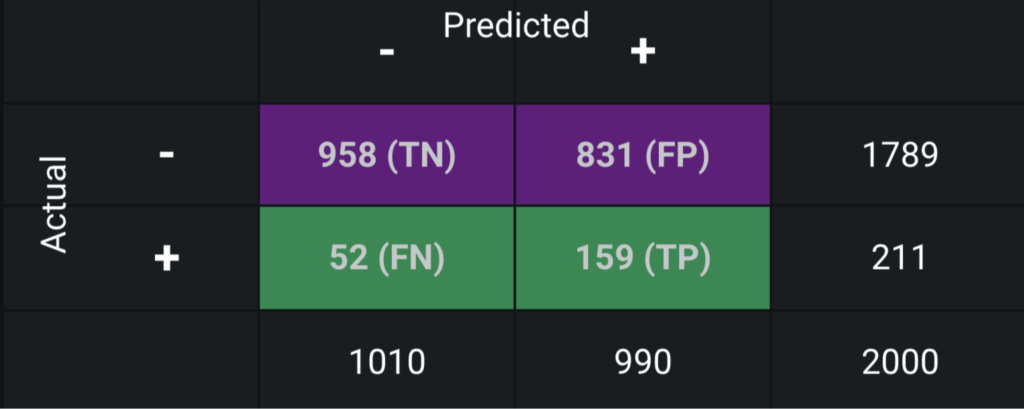

The confusion matrix shows that, of 2,000 customers in the holdout partition, the model predicted 990 customers as likely to accept the offer and 1,010 customers as not likely to purchase. Of the 990 customers predicted as likely to accept, 159 actually accepted. By recommending the offer to the top half of the customers, sales agents will be able to win 159 of the 211 customers.

Post-Processing

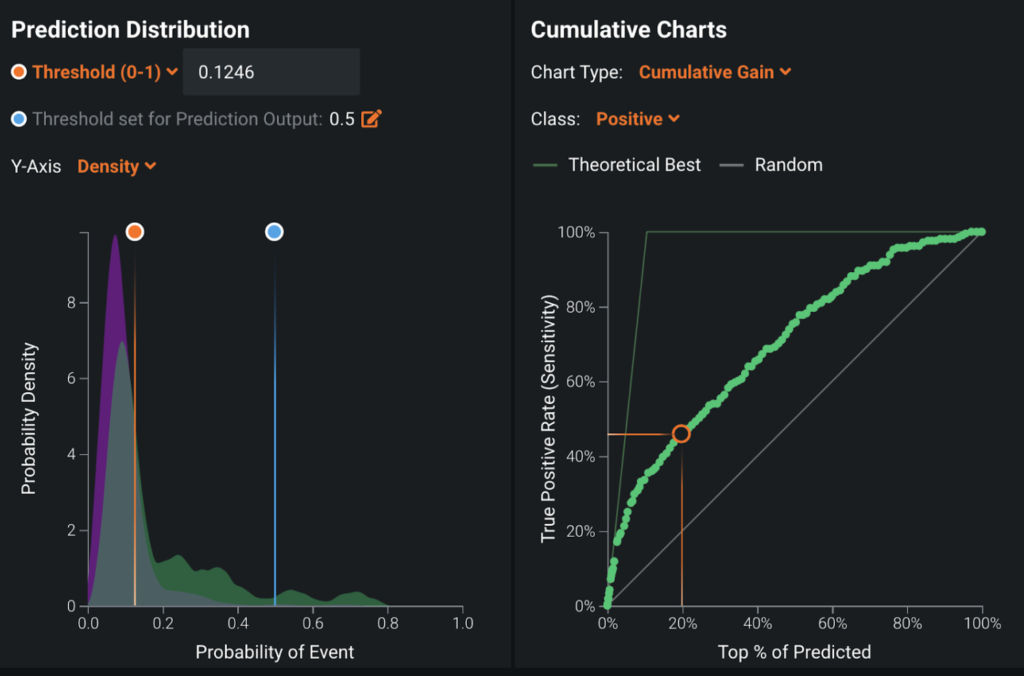

To convert model predictions into decisions, you can use the ROC Curve tab to determine the best threshold to classify whether or not the customer will accept the offer. For example, if you want to minimize false positives, you can set a higher threshold; if you want to minimize false negatives, you can set a lower threshold.

Business Implementation

Decision Environment

After you finalize the model, DataRobot makes it easy to deploy the model into your desired decision environment. Decision environments are the methods by which predictions will ultimately be used for decision making.

Decision Maturity

Automation | Augmentation | Blend

The predictive model can either automate recommendations made to customers through an application or augment the agent’s ability to cross-sell products through direct communication. In both cases, customers are given offers which are most relevant to their unique needs.

Model Deployment

All models built by DataRobot AutoML can immediately be deployed through an API, batch script, download, or drag and drop.

For this use case, the predictions can be deployed through an API and automatically sent to the BRMS. After the BRMS filters the products eligible for the customer, these can be displayed in an application accessible to the sales agents.

Decision Stakeholders

Decision Executors

The next best offer will be displayed through an application that the sales agent uses during a sales conversation with the customer.

Decision Managers

Executives monitor the KPI dashboard, which visualizes the results for the decision logic. For example, they track the number of up-sell and cross-sell acceptances, and discuss with decision authors how to improve the decision logic each week.

Decision Authors

Senior managers in the sales department examine the performance of the decision logic by receiving input from decision executors and decision managers. For example, decision executors will inform whether or not the offers they receive are reasonable, and decision managers will inform whether or not the rate of up-sell is as expected. Based on the inputs, decision authors update the decision logic each week.

Decision Process

For each customer, the application can sort the products from highest to lowest acceptance. If the score of the product with highest acceptance is above threshold, but the business rule indicates that the customer is eligible for the product, then the product can be offered to the customer during the sales conversation.

Model Monitoring

The decision authors can regularly update the decision logic. For example, they might add a plan to the available offers. At the same time, they will monitor the cross-sell model and retrain the model if data drift reaches a certain threshold.

Implementation Risks

Business goals should determine decision logic, not data. The project starts from business users building decision logic to improve business processes. Once decision logic is ready, true data needs will become clear.

Integrating business rules and machine learning to production systems can be problematic. Business rules and machine learning models need to be updated frequently. Externalizing the rules engine and machine learning allows decision authors to improve decision logic often. When the rules engine and machine learning are integrated into production systems, updating decision logic becomes difficult because it will require changes to production systems.

Experience the DataRobot AI Platform

Less Friction, More AI. Get Started Today With a Free 30-Day Trial.

Sign Up for FreeExplore More Use Cases

-

InsurancePredict Policy Churn For New Customers

Ensure the long term profitability of incoming members by predicting whether they will churn within the first 12 months of a policy application.

Learn More -

InsurancePredict Claims Litigation

Predict from first notice of loss which claims have a high risk of going to litigation.

Learn More -

InsurancePredict Individual Loss Development

Predict loss development on every individual claim based on their unique attributes.

Learn More -

InsuranceDynamic Pricing for Non-US Insurers

Dynamic pricing based on an accurate understanding of claim risk and a customer’s intent to buy can help target personalized pricing to a prospective client.

Learn More

-

InsurancePredict Policy Churn For New Customers

Ensure the long term profitability of incoming members by predicting whether they will churn within the first 12 months of a policy application.

Learn More -

InsurancePredict Claims Litigation

Predict from first notice of loss which claims have a high risk of going to litigation.

Learn More -

InsurancePredict Individual Loss Development

Predict loss development on every individual claim based on their unique attributes.

Learn More -

InsuranceDynamic Pricing for Non-US Insurers

Dynamic pricing based on an accurate understanding of claim risk and a customer’s intent to buy can help target personalized pricing to a prospective client.

Learn More